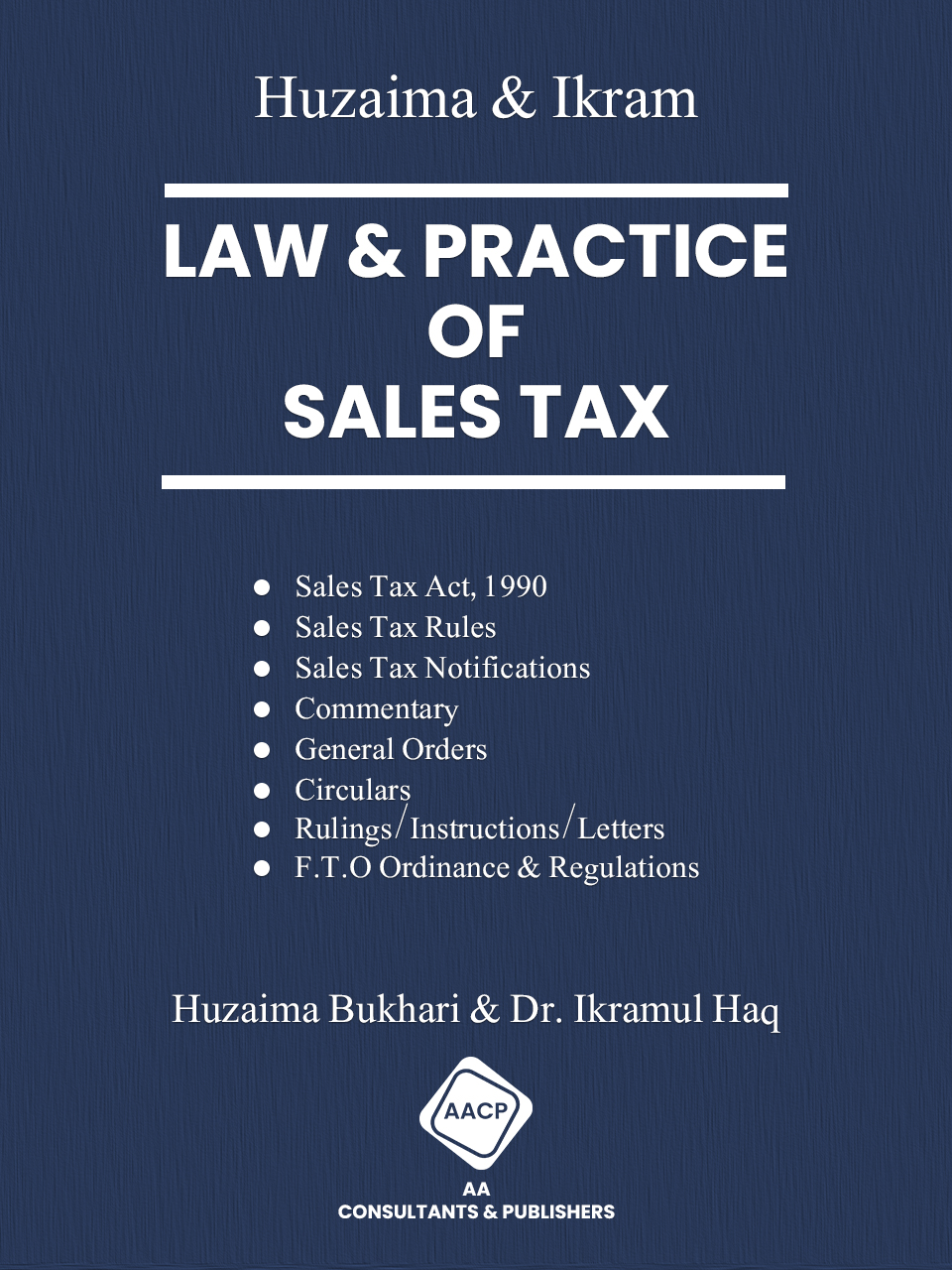

Law & Practice of Sales Tax

The book in loose-leaf (two volumes) contains comprehensive section-wise analysis of variousprovisions with case – law and departmental circulars/instructions etc. It is backed by regular updating facility. This is the first ever commentary on sales tax in Pakistan that is practical as well as lucid. It contains everything that one requires to understand about this vital and ever-expanding tax, especially after introduction of FED in VAT mode.

VOLUME-I

- Sale

- s Tax Act, 1990

- Sales Tax RulesSales Tax Notifications

VOLUME-II

PART-I

*Synopsis of entire Sales Tax Act, 1990

with exhaustive commentary covering*

- History and Evolution

- Basic Concepts

- Charge, Scope and Exemptions

- Registration, Record and Returns

- Offences and Penalties

- Appeals, Revisions and Dispute Resolution

- Sales Tax & Federal Excise Budgetary Measures

PART-II

- General Orders

- Circulars

- Circular Letters/Rulings etc.

- Federal Ombudsmen Institutional Reforms Act, 2013

- Federal Tax Ombudsman Ordinance, 2000

- Federal Tax Ombudsman Investigation & Disposal of Complaints Regulations, 2001

- Decision by President of Pakistan u/s 32 of Federal Tax Ombudsman Ordinance, 2000